Strengthen client portfolios with Structured Notes - stop diversifying.

Structured Notes are no longer a tool limited to institutional and high-net-worth investors.

Today, minimum investments can begin as low as $1,000.

Better structure, better outcomes?

Structured Notes represent the next big leap in portfolio personalization. Clients are demanding a better investment experience and structured investments can help.

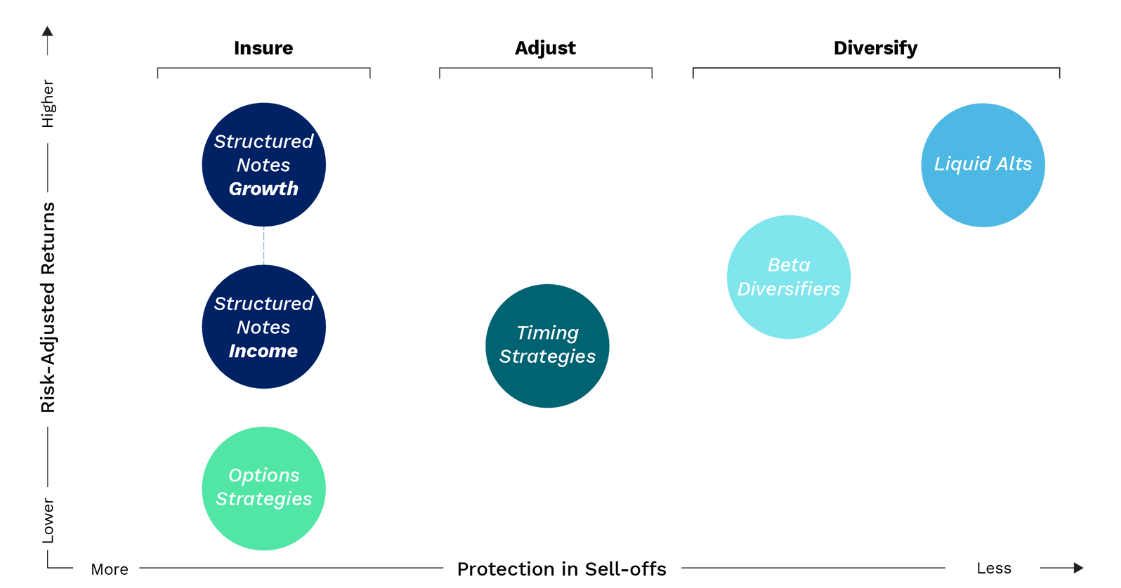

Enhance your current process

Structured Notes can be an efficient way to help hedge market risks – that’s right, you can keep upside potential, but add explicit downside protection.

Benefits of Structured Notes

01

Potential for equity-like returns, but with potentially lower investment variability and reduced drawdowns.

02

Risk mitigation beyond conventional diversification can result in less stress over market volatility and greater desire to stay invested.

03

Enhanced yield and improved upside potential (relative to similar assets) to better meet investment objectives.

At Fontavis Finance, we offer a diverse range of structured notes designed to provide investors with unique investment opportunities and customized solutions.

Our structured notes combine traditional investments with derivative instruments, allowing you to access a variety of asset classes and tailor your investment strategy to meet your specific goals. With Fontavis Finance Structured Notes, you can enhance your portfolio diversification and potentially achieve higher returns while managing risk.

What are Structured Notes?

Structured notes are hybrid securities that combine a traditional investment component, such as bonds or stocks, with a derivative component, such as options or swaps.

These notes offer investors exposure to different underlying assets or investment strategies while incorporating specific risk profiles and return characteristics. Structured notes provide flexibility and customization, making them suitable for a wide range of investment objectives.

Grow your book with a high demand product

Stung by market swings and a poor investment experience, investors are increasingly demanding access to structured investments.

Structured Notes are now a large global market, with more than $3 trillion outstanding. Born in Europe in the mid-1970s, across Europe and Asia, and more recently the U.S., notes are a mature and growing market.

There’s the hard way, and the Fundsgate way…