Downtown Commerce Center

Nashville, TN

Overview

Performance

Property Value Performance

Financial Details

Investment Overview

Cash Flow Analysis

Risk Metrics

Return Breakdown

Property Information

Basic Information

Physical Characteristics

Investment Strategy

Key Metrics

Investment Thesis

Nashville's diverse economy and continued population growth support strong office fundamentals. Recent renovations have positioned the property to attract quality tenants.

Location

550 Commerce Street

Nashville, TN 37203, US

Full Address

550 Commerce Street

Nashville, TN 37203

Property Type

Office - Class B

Year Built

1985 (Renovated 2018)

Property Size

185,000 sq ft

Amenities & Features

Property Amenities

Key Investment Features

Our strategy

Real Estate Investment Strategy

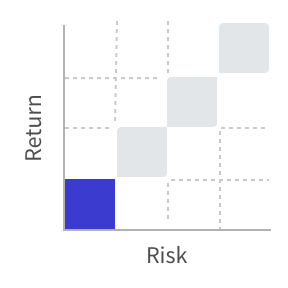

Build a diversified portfolio of institutional-quality real estate assets that generate stable income and long-term appreciation

- Expected variability of return: Low to Moderate

- Timing of expected return: Quarterly distributions from rental income

- Primary expected source of returns: Rental income and property appreciation

- Asset focus: Income-generating properties in growing markets

- Geographic strategy: Diversified across major metropolitan markets

- Property management: Professional third-party management with institutional oversight

This section is intended to provide a general overview of the investment strategy for educational purposes only, and is not meant to be representative of the specific details of any individual investment. All investments involve risk; there are no guarantees of any returns.